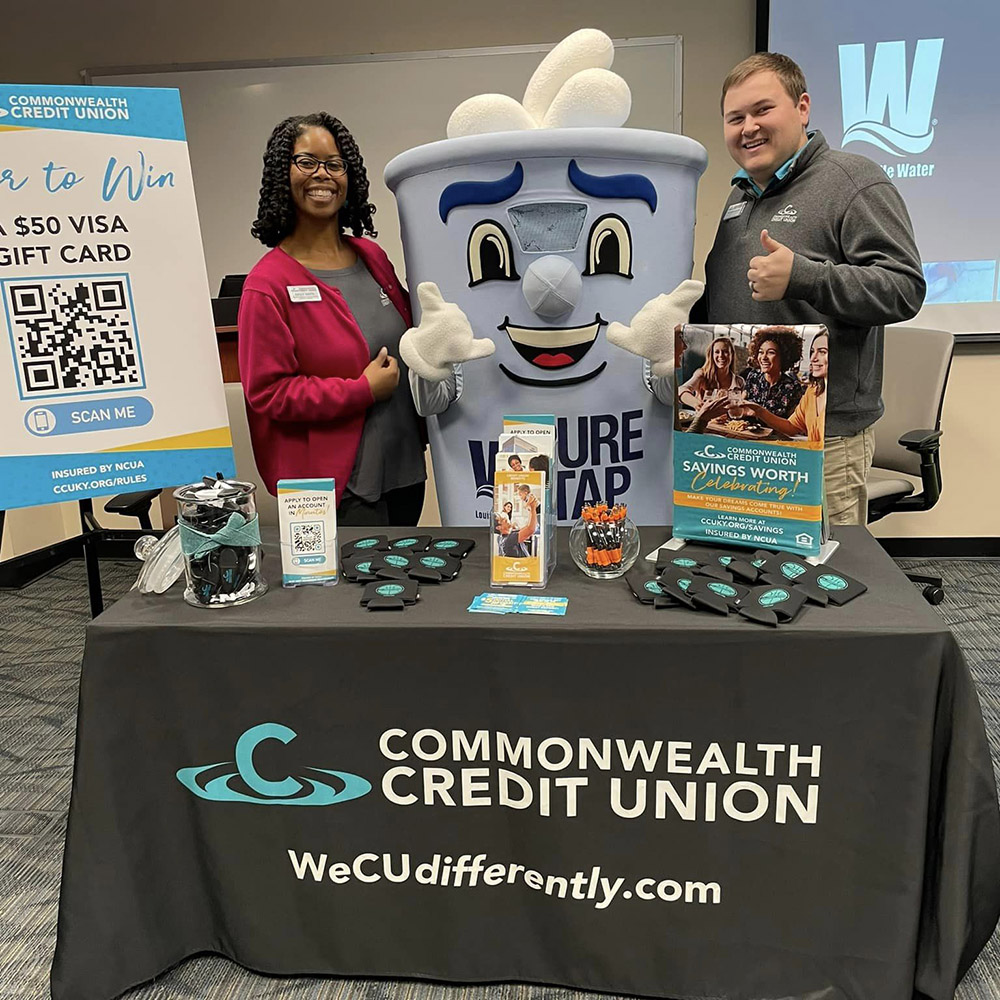

Commonwealth Credit Union (CCU) has been supporting Kentucky families since 1951. With 17 branches across central Kentucky and Louisville Metro, the CCU team takes pride in serving its members.

“We are all about bettering the lives of our members and their families,” said Glenn Griffin, CCU operations regional manager. “We are about financial empowerment and education. We want our members to understand what they’re doing and how it impacts their home and family.”

CCU offers a variety of financial services including savings, checking and retirement accounts, credit cards, and loans for home and auto. Membership is open to anyone who lives, works, worships, attends school or volunteers in 25 different Kentucky counties, including Jefferson, Bullitt, Oldham and Shelby.

“Commonwealth Credit Union has shown remarkable growth this year,” Griffin said. “Not only are we growing in the traditional sense – member and asset growth – but we’re also growing in our knowledge base. This year we introduced a new operations training department, which has provided a consistent training plan for all front-line team members. We also continued to field feedback from our members and implement new initiatives where it makes the most strategic sense. Additionally, we rolled out new products such as Power Checking, Personal Goal Savings and, throughout the year, an array of Certificate Specials to help our members take advantage of the current interest rate environment. We also continue to offer a powerful home equity line of credit, and other dynamic loans like our Recreational and Adventure loans.”

CCU is backed by the National Credit Union Administration, which federally insures savings to at least $250,000. CCU purchases additional insurance through Excess Share Insurance, which adds $100,000 in protection for its members. Griffin said everyone should feel secure having their money at CCU.

“We work continually to provide exceptional service, learn from our members and implement their suggestions where applicable,” he said. “If it’s a suggestion we can’t implement, we provide them with the ‘why’ behind our decision-making process and help them understand our approach. Our Credit Union has been in business since 1951, and while that is a long time, we’re not done growing and adapting to current technology, trends and member needs. We are excited to be part of an evolution much larger than ourselves.”

“We want to ensure we are offering what is beneficial to you and your family,” Griffin added. “We do a lot of giveback and love participating in every community we’re in. These are our homes and neighbors and friends. It’s a really unique experience to be part of a credit union. With our robust digital banking applications, we’re available to our members seven days a week. Stay tuned; the future is looking very exciting!”