Hendricks County Bank and Trust is Built on Relationships and Community

Photographer / Amy Payne

The main office building of Hendricks County Bank and Trust Company (HCBT) stands tall, occupying a wide swath of land on the corner of Green and Main streets in Brownsburg. Its entire front face, curved and lined with windows from top to bottom, adds to the charm and freshness of downtown Brownsburg’s updated look.

The bank is operated by executives who have lived, breathed and worked in Hendricks County for years.

“One of the most charming pieces of who we are is that we all live and work here in Hendricks County,” says Melissa Yetter, director of marketing for the bank. “We all go to church here. We shop here. This is our home too.”

The bank’s executives are long-time locals. President Jerry Orem moved to Hendricks County from Richmond, Indianapolis, in the 1990s. Executive Vice President David McKee was offered a job at the bank just out of college, and he’s been there ever since. Chief Financial Officer Van Nguyen will celebrate his 10th anniversary at HCBT in January. Chairman and Chief Executive Officer Stephen Denhart grew up in the banking world in Brownsburg. In fact, he is celebrating his 49th anniversary with HCBT this year.

Denhart and McKee have served in nearly every capacity at HCBT. They’ve been bookkeepers, tellers, lenders, marketers, branch managers and loan operations specialists. In fact, they both started in the basement of the company’s previous building.

“Of all the jobs I had, being a teller was my favorite,” Denhart says. “I just loved the people. I got to see everyone.”

Seeing everyone is something Nguyen values about his job as well. With a career background at big banks, Nguyen prides himself on the fact he knows nearly every single employee at Hendricks County Bank.

“You can’t say that at big banks,” he says. “I really like that. That’s why I’ve stayed.”

Being a local bank gives HCBT an edge on bigger banks.

“All banks offer the same thing,” McKee says. “Internet banking, mobile apps, lending options, etcetera. Money is all green. The biggest difference is us. You get us. We are local. And we are willing to sit down with you.”

Nguyen says despite the bank’s size, the HCBT staff is up to speed on the technology it can offer customers.

“We have done a very good job making sure we have the technology to compete with the bigger boys in this industry,” he says, adding that the company offers mobile banking and online banking, and also partners with atm services around the world.

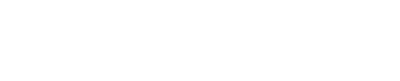

The company’s executives also have an affinity for the rich history of the bank. The bank chartered and opened in 1908 as Brownsburg State Bank on the very same corner where it resides now. That building was torn down, and a second one was built in the early 1960s.

The bank operated as Brownsburg State Bank through the early 1970s, but the company outgrew its space, even moving some of its offices across the street. The HCBT staff celebrated the grand opening of a brand-new building and headquarters – four times bigger than the previous building – in July of 2019.

Orem says the new building is a significant symbol of the bank’s loyalty and dedication to the Hendricks County community and surrounding areas.

“We made a significant investment in the Town of Brownsburg with the construction of the building,” he says. “It was a sign of faith to what this community is becoming. It really helped bring us all together, and showed the community we are committed.”

The design of the building was intended to complement the updated aesthetic of downtown Brownsburg. While the physical building is attractive, the bank’s executives hope the leadership and operations are what draw in customers.

“When people walk into this bank, they’re treated like they’ve been here years and years,” Denhart says. “If you have a problem, call us here and we’ll get everything provided up front so someone can help you one-on-one.”

When Denhart talks about working one-on-one with customers, he includes himself and other executives in the equation.

Yetter says whoever is in the office helping customers will be there day after day, as opposed to a larger bank with different employees present from one day to the next.

As a local bank, HCBT is involved in the community in unique ways. The bank contributes to the local YMCA in Avon. They’re part of the Hendricks County Economic Development Partnership. The staff also enjoys participating in the Hendricks County 4-H fair each year by sponsoring the queen contest, showmanship contest and livestock auction.

“We usually go to the auction, get a list of participants, and we go through and find out customers and bid on their kids’ animals,” Orem says. “It’s a lot of fun.”

Due to the coronavirus-related cancellation of the fair this year, HCBT will have to simply make a donation.

The coronavirus has affected the banking industry in ways no one could have anticipated. However, the positive attitude of the entire HCBT executive committee and their silver-lining approach keep them focused on business.

“We went into 2020 with a very strong economy and a pretty big budget for growth and expectations,” Orem says. “February 2020 turned that on its head, but the bright spot is with lower interest rates, mortgage lending has been tremendously active and paycheck protection program lending has been very good as well. It’s not the year we anticipated, but it’s still been a good year.”

The bank’s customer traffic is almost back to normal following a few months of closed lobbies, and there has been a recent increase in digital activity.

“This group of executive committee members have been able to talk and adapt, and change immediately,” Yetter says. “It wasn’t something we had to incorporate, and get changed and approved by corporate. They did a great job of managing that, just being nimble, and ready to adapt and move forward.”

The HCBT staff is always looking for ways to offer customers the kinds of services that make banking easy and safe. They recently launched a partnership with Zelle, a digital payment network, to offer a person-to-person payment option similar to PayPal or Venmo services. Bank leaders are also exploring an increased online presence.

“I can foresee a day at this bank where you can obtain a deposit account or loan, like RadCred, without ever stepping foot in the bank,” Orem says. “We’d absolutely rather see our customers but we know people want that option.”

Orem’s goal is for customers to feel the bank and its employees are approachable.

“We want people to overcome their fear of talking to a banker about their goals and dreams,” he says. “Here, you’re talking to your neighbors. We want to help you realize those dreams.”

The staff’s approach and readiness to help customers, even during a global pandemic, underscore its commitment to the community.

“We wouldn’t be doing this if it wasn’t fun,” McKee says. “We enjoy coming to work every day. We like seeing the customers. We want to be their bank of choice and partner in their financial planning.”

Hendricks County Bank and Trust Company’s main office is located at 1 East Main Street in Brownsburg. For more info, call 317-852-2268 and visit hendrickscountybank.com.